The requirements and fees to obtain a California real estate license are detailed here. Also, you should know the different forms you will need to submit with your application. These forms will allow you to prepare for the licensing exam. This article will give you an overview of the licensing process and show you how to complete the required documents.

California Real Estate License Requirements

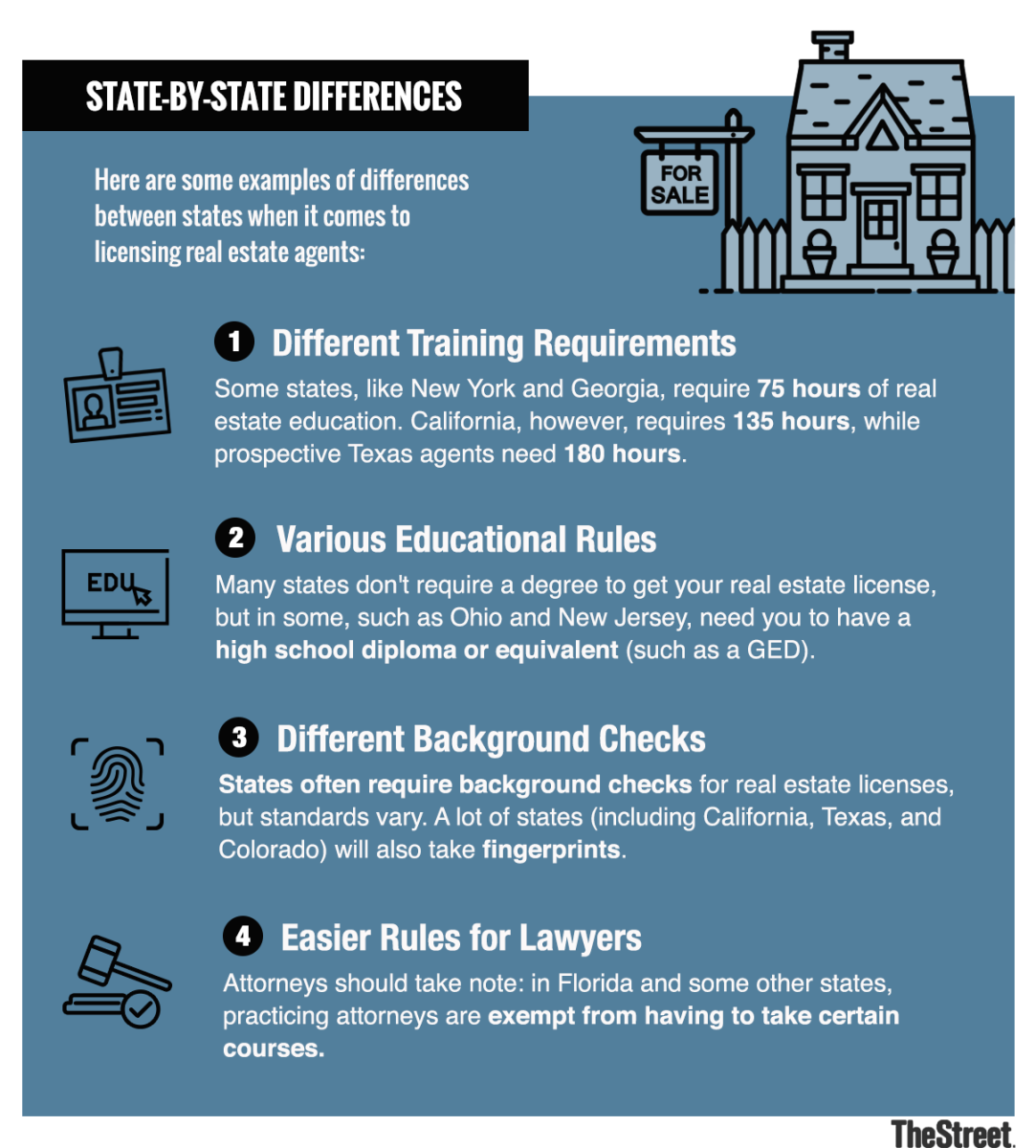

Pre-licensing classes are required in order to become a licensed California realty agent. These courses must include either three semester-units of four quarter-units on the college level. They must be completed by an institution of higher study that has been accredited by the Western Association of Schools and Colleges (or a regional accreditation agency). Further, 45 hours must be spent in training related to real estate at a private school approved by California Real Estate Commission.

Along with submitting an application, your fingerprints must be submitted to the DOJ's Live Scan Program. These fingerprints will serve as background checks. The fees for fingerprinting are non-refundable and must be scheduled at a convenient time.

California real estate license fees

The first step in getting a real estate license in California is to apply for it. This can be done in a variety of ways, such as attending real estate school and taking an online course. This approach offers many benefits. It allows you to learn in a supportive atmosphere while saving time and money. But, you should remember that California's real estate license comes with certain requirements.

California sells a license to salespersons for $60. Brokers are $95. To apply for a California real estate license, applicants must complete an application through the state's eLicensing system. Both license types must pass an exam. The exam for the salesperson license lasts three hours. It includes 150 multiple-choice question. For the broker license, the exam takes four hours and involves 200 multiple-choice questions. A passing score of 70% is required to be granted a license.

Formularies to be included in an application for a real-estate license

To become a California real-estate agent, one must apply for a license. The required coursework must be completed and you must have at least two years' experience in licensed sales. This includes both full-time as well as part-time jobs. A packet of information with the necessary forms will be sent to your email address after you submit your request.

A fingerprint form will also be required. This form should be sent by mail to Bureau of Real Estate, P.O. Box 137002 in Sacramento, California. If you plan to open a separate branch, you will also need to submit a Branch Office License Applications.

The Salesperson License Application must be attached and paid. If you are not from the United States, you must fill in a Consent form to Service of Process. You must complete this form within one year of passing your salesperson exam. You should ensure you have fulfilled all requirements and maintain a checklist for your preparation. This will help save you time later.

FAQ

What is a reverse mortgage?

A reverse mortgage allows you to borrow money from your house without having to sell any of the equity. It allows you to borrow money from your home while still living in it. There are two types: government-insured and conventional. If you take out a conventional reverse mortgage, the principal amount borrowed must be repaid along with an origination cost. FHA insurance covers the repayment.

Should I rent or buy a condominium?

If you plan to stay in your condo for only a short period of time, renting might be a good option. Renting allows you to avoid paying maintenance fees and other monthly charges. On the other hand, buying a condo gives you ownership rights to the unit. You can use the space as you see fit.

What are the key factors to consider when you invest in real estate?

The first thing to do is ensure you have enough money to invest in real estate. You will need to borrow money from a bank if you don’t have enough cash. It is also important to ensure that you do not get into debt. You may find yourself in defaulting on your loan.

You also need to make sure that you know how much you can spend on an investment property each month. This amount should cover all costs associated with the property, such as mortgage payments and insurance.

It is important to ensure safety in the area you are looking at purchasing an investment property. It would be best to look at properties while you are away.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to Rent a House

Finding houses to rent is one of the most common tasks for people who want to move into new places. But finding the right house can take some time. There are many factors that can influence your decision-making process in choosing a home. These factors include size, amenities, price range, location and many others.

We recommend you begin looking for properties as soon as possible to ensure you get the best deal. You should also consider asking friends, family members, landlords, real estate agents, and property managers for recommendations. This will ensure that you have many options.