If you've ever wondered how to make money on property, you're not alone. There are many ways that property can bring you cash, including buying raw land, a second home, and investing in a foreclosed house. Here are some strategies and tips that can help you get going. Whatever you do, don't forget to allow for setbacks or unexpected costs. These are some of the most well-known methods.

Renting out rooms in your house

Renting out rooms in your home is an option if it's your own property. While you may not need to rent the rooms out, this can still be a great way of making extra money. Here are some tips to get started. First, prepare the room for rent. You must ensure that the room has electricity and heating. If there is a bath, tell the tenant. Know how to market the room.

Investing In A Second Home

There are many benefits to investing in a second home. You can enjoy the comforts of your second residence while still making money. You can use part your savings to buy a new home and the rest to invest in an investment. Even if the second house is not used, it can be rented out to make a profit. A second home is a great way to build your portfolio and get the financial security that you want.

Buy a Foreclosure

There are a few things to keep in mind when investing in foreclosures. Before you buy, you need to have a plan. You can either flip the house or hold the home for the long haul. Both strategies can yield good profits. It is up to you to decide which strategy works best for your situation and finances. These tips will help you make the most of your money.

Investing in land raw

Investing in raw land has many benefits for real estate investors. Raw land can be converted into numerous entities, including commercial and residential, unlike commercial and residential property. It doesn't matter if you invest in a single unit of land or several units. The potential for profits is enormous. You can also earn handsome returns over the long-term because raw land is subject to appreciation.

Investing In Multi-Family Housing

Real estate investing can be a great way of increasing your net worth in the long term. Multifamily properties are a great investment option for people who have a basic need. These properties allow people to own a home, even if they don't have the money. This property investment has low risk. But it is crucial to review all details of these properties and to speak with an expert. Many landlords purchase multifamily properties with the hopes of generating extra income each month or reducing the cost of home ownership.

FAQ

Can I get another mortgage?

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

How can I fix my roof

Roofs can become leaky due to wear and tear, weather conditions, or improper maintenance. Minor repairs and replacements can be done by roofing contractors. Contact us to find out more.

What should you look for in an agent who is a mortgage lender?

A mortgage broker assists people who aren’t eligible for traditional mortgages. They work with a variety of lenders to find the best deal. Some brokers charge fees for this service. Others provide free services.

Do I need to rent or buy a condo?

Renting could be a good choice if you intend to rent your condo for a shorter period. Renting allows you to avoid paying maintenance fees and other monthly charges. A condo purchase gives you full ownership of the unit. You have the freedom to use the space however you like.

How can I eliminate termites & other insects?

Over time, termites and other pests can take over your home. They can cause severe damage to wooden structures, such as decks and furniture. To prevent this from happening, make sure to hire a professional pest control company to inspect your home regularly.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

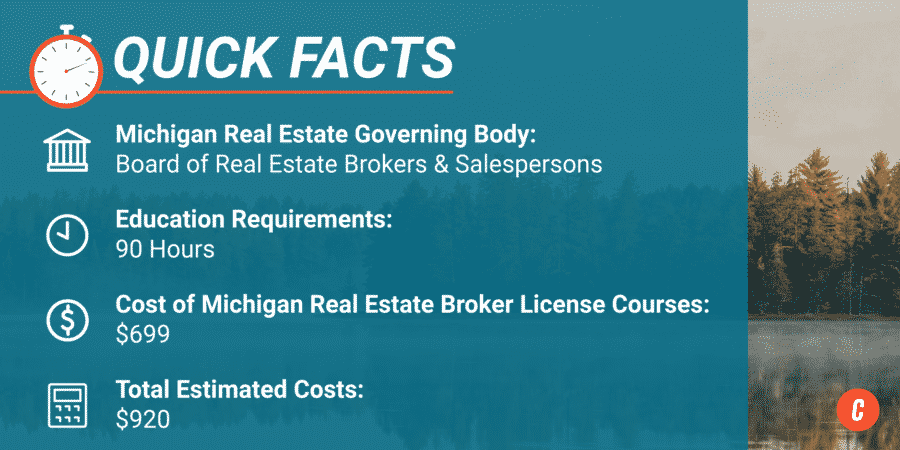

How to become an agent in real estate

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This requires studying for at minimum 2 hours per night over a 3 month period.

You are now ready to take your final exam. In order to become a real estate agent, your score must be at least 80%.

These exams are passed and you can now work as an agent in real estate.