Passing a test will be the first step in becoming an agent. This is not an easy task. Many people fail it the first time they attempt. Some people fail the exam completely. There are many other options for obtaining your license. This article will outline some of the requirements that you'll need to meet as well as the associated costs.

There are other options available for obtaining a real-estate license

There are several options to get your real estate license. First, you have the option to complete pre-licensing school. This will vary from one state to the next. Next, you will need to take the real estate licensing exam in the state where you plan to practice. This exam is offered by multiple testing companies.

While a real-estate license isn’t necessary for every job, it can make you an asset in many fields. Even though a majority of government jobs do require a real property license, many prefer people with real-world knowledge. These positions include buying and disposing unused space, negotiating leases, and purchasing right of way. These positions can be found at many government agencies, including the County, State, and Department of Homeland Security.

Another advantage of taking a pre-licensing education course is that you can study at your own pace. The provider may allow you to complete the course within two weeks. Online pre-licensing courses are self-paced, but require a lot of study and preparation.

Requirements for getting a real estate license

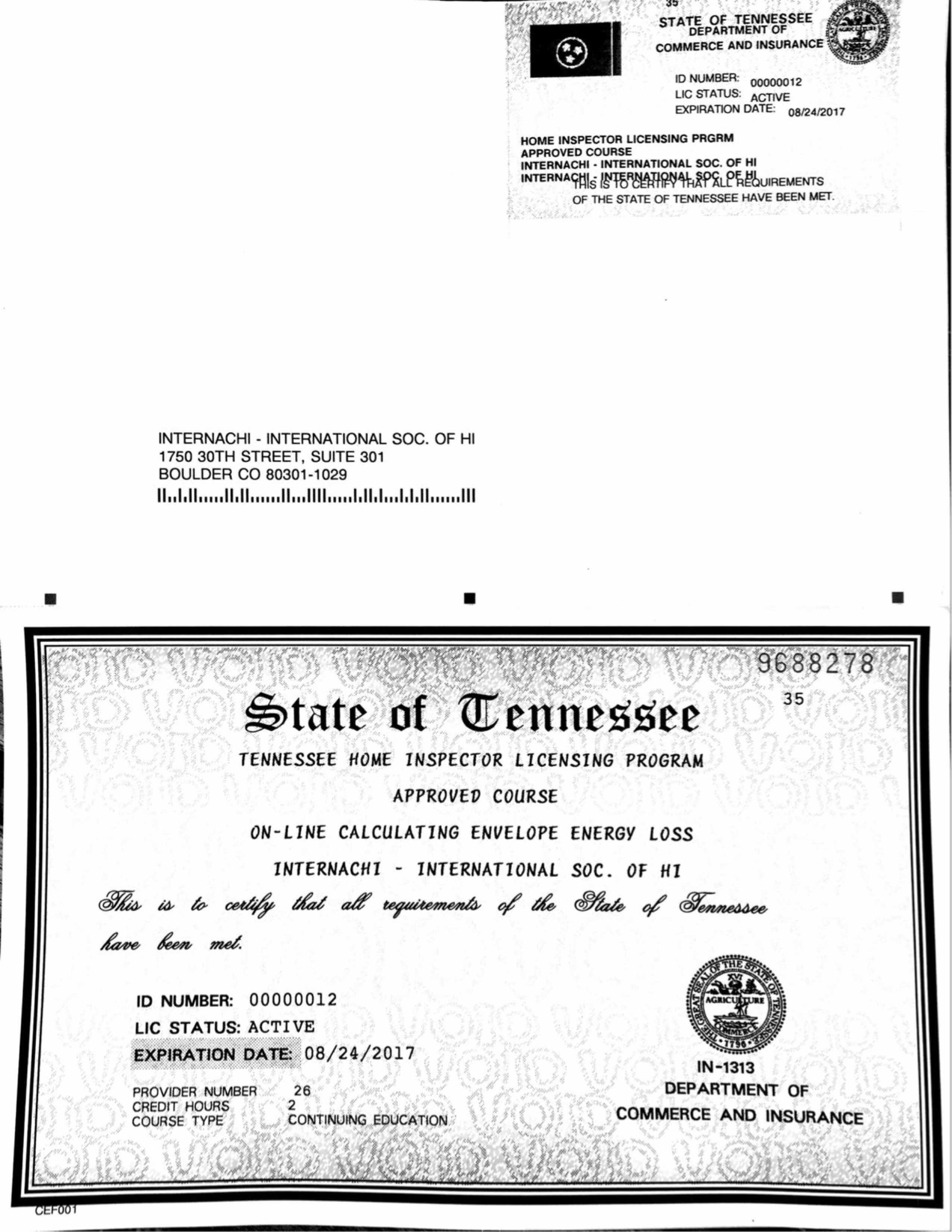

There are several things you need to do if you want to be licensed as a realty agent. The first requirement is that you have the appropriate education. You must be able produce proof of education including letters from teachers, certificates of completion, and grade reports. Also, you should have proper insurance coverage. This includes errors and omissions insurance. A listing contract is an important part of your role as a real-estate agent.

Once you have completed the prerequisite education and completed your pre-licensing classes, you can sit for the state exam. Depending on your state, you may have to take a remedial course after your initial training to refresh your knowledge. You will need to pass the exam and submit your fingerprints. Remember that the application fee is non-refundable.

Cost of getting a real estate license

There are many costs associated with obtaining your real estate license. These vary depending on where you reside. Pre-license education typically costs between $100 and $900. Licensing fees can also be a factor. To keep current on state laws, you may be required to attend periodic courses. These courses serve as information refreshers, and allow you to learn more about your industry. These courses are often paid for by brokerages.

The cost of pre-licensing education in New York is about $325. This includes a 75 hr pre-licensing training. It also includes fingerprinting or background checks.

FAQ

How long does it take for a mortgage to be approved?

It depends on several factors such as credit score, income level, type of loan, etc. It generally takes about 30 days to get your mortgage approved.

What amount should I save to buy a house?

It depends on the length of your stay. If you want to stay for at least five years, you must start saving now. You don't have too much to worry about if you plan on moving in the next two years.

What should I consider when investing my money in real estate

The first thing to do is ensure you have enough money to invest in real estate. If you don’t save enough money, you will have to borrow money at a bank. It is also important to ensure that you do not get into debt. You may find yourself in defaulting on your loan.

You should also know how much you are allowed to spend each month on investment properties. This amount must cover all expenses related to owning the property, including mortgage payments, taxes, insurance, and maintenance costs.

Finally, ensure the safety of your area before you buy an investment property. It is best to live elsewhere while you look at properties.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to buy a mobile home

Mobile homes are houses built on wheels and towed behind one or more vehicles. Mobile homes were popularized by soldiers who had lost the home they loved during World War II. People who want to live outside of the city are now using mobile homes. There are many options for these houses. Some are small, while others are large enough to hold several families. You can even find some that are just for pets!

There are two main types mobile homes. The first type is produced in factories and assembled by workers piece by piece. This is done before the product is delivered to the customer. A second option is to build your own mobile house. First, you'll need to determine the size you would like and whether it should have electricity, plumbing or a stove. Next, make sure you have all the necessary materials to build your home. The permits will be required to build your new house.

You should consider these three points when you are looking for a mobile residence. A larger model with more floor space is better for those who don't have garage access. A model with more living space might be a better choice if you intend to move into your new home right away. You should also inspect the trailer. Damaged frames can cause problems in the future.

Before you decide to buy a mobile-home, it is important that you know what your budget is. It's important to compare prices among various manufacturers and models. Also, take a look at the condition and age of the trailers. Many dealers offer financing options. However, interest rates vary greatly depending upon the lender.

It is possible to rent a mobile house instead of buying one. Renting allows you to test drive a particular model without making a commitment. Renting is not cheap. Renters typically pay $300 per month.