Cash-only home purchases can save you a lot of money. However, it's not for everyone.

Even though buying a house in cash is becoming more popular, it's still important to consider the pros before making a final decision. Finding out if cash is an option for you to purchase a property is also important.

Can I Purchase a Home With Cash?

Cash is an excellent way to buy a house and ensure that you are getting the right home at the right price. It is advantageous to pay for your home in cash. This way, you will not have to make mortgage payments each month, eliminate interest payments, or spend money on closing fees.

The buyer must be able provide evidence of sufficient funds, at least within a few days after an agreement is made - if not before signing the contract. This evidence can be in the form a bank statement, or a letter from a credit institution.

The deposit will be called the earnest deposit or good faith. This deposit should be a small amount, typically around 1% of the total sale price.

The amount you pay as earnest deposit depends on what you want to purchase. But it should still be enough for the seller to accept your offer, and to confirm that you can afford the home. It will also show the seller that you have good faith and are serious about purchasing the home.

What Can I Do to Buy a Home With Cash

You may want to consider paying for your house in cash if you've got a lot of liquid money stashed away in accounts like savings, checking, and money markets. Cash can be useful to buyers who may have difficulty obtaining a mortgage or who wish to save in a market with high risks.

Having a large amount of cash can also be helpful if you have a thin credit file, which can prevent you from getting a mortgage. It can happen to people who are immigrants, who have returned to the United States from abroad or who don't use credit at all.

A cash payment for your home can enable you to buy homes that you would not be able otherwise to afford. Home prices are often higher than average salaries, making it hard for many people to get a mortgage.

The downside of buying a home with cash is that it can be difficult to predict how long it will take to sell a house in this competitive market. There's always the chance that a loan will not be approved or the appraisal may not come through if a sale depends on it.

Cash offers are very popular with sellers because they remove the risk associated with a bank loan, and give them greater deal certainty. They are also happy that the transaction can be completed more quickly with less hassle.

FAQ

How much does it cost to replace windows?

Replacing windows costs between $1,500-$3,000 per window. The cost to replace all your windows depends on their size, style and brand.

How much money will I get for my home?

This can vary greatly depending on many factors like the condition of your house and how long it's been on the market. Zillow.com shows that the average home sells for $203,000 in the US. This

What should I consider when investing my money in real estate

It is important to ensure that you have enough money in order to invest your money in real estate. If you don’t have the money to invest in real estate, you can borrow money from a bank. Aside from making sure that you aren't in debt, it is also important to know that defaulting on a loan will result in you not being able to repay the amount you borrowed.

It is also important to know how much money you can afford each month for an investment property. This amount must include all expenses associated with owning the property such as mortgage payments, insurance, maintenance, and taxes.

You must also ensure that your investment property is secure. It would be best if you lived elsewhere while looking at properties.

Can I buy my house without a down payment

Yes! Yes! There are many programs that make it possible for people with low incomes to buy a house. These programs include conventional mortgages, VA loans, USDA loans and government-backed loans (FHA), VA loan, USDA loans, as well as conventional loans. Check out our website for additional information.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

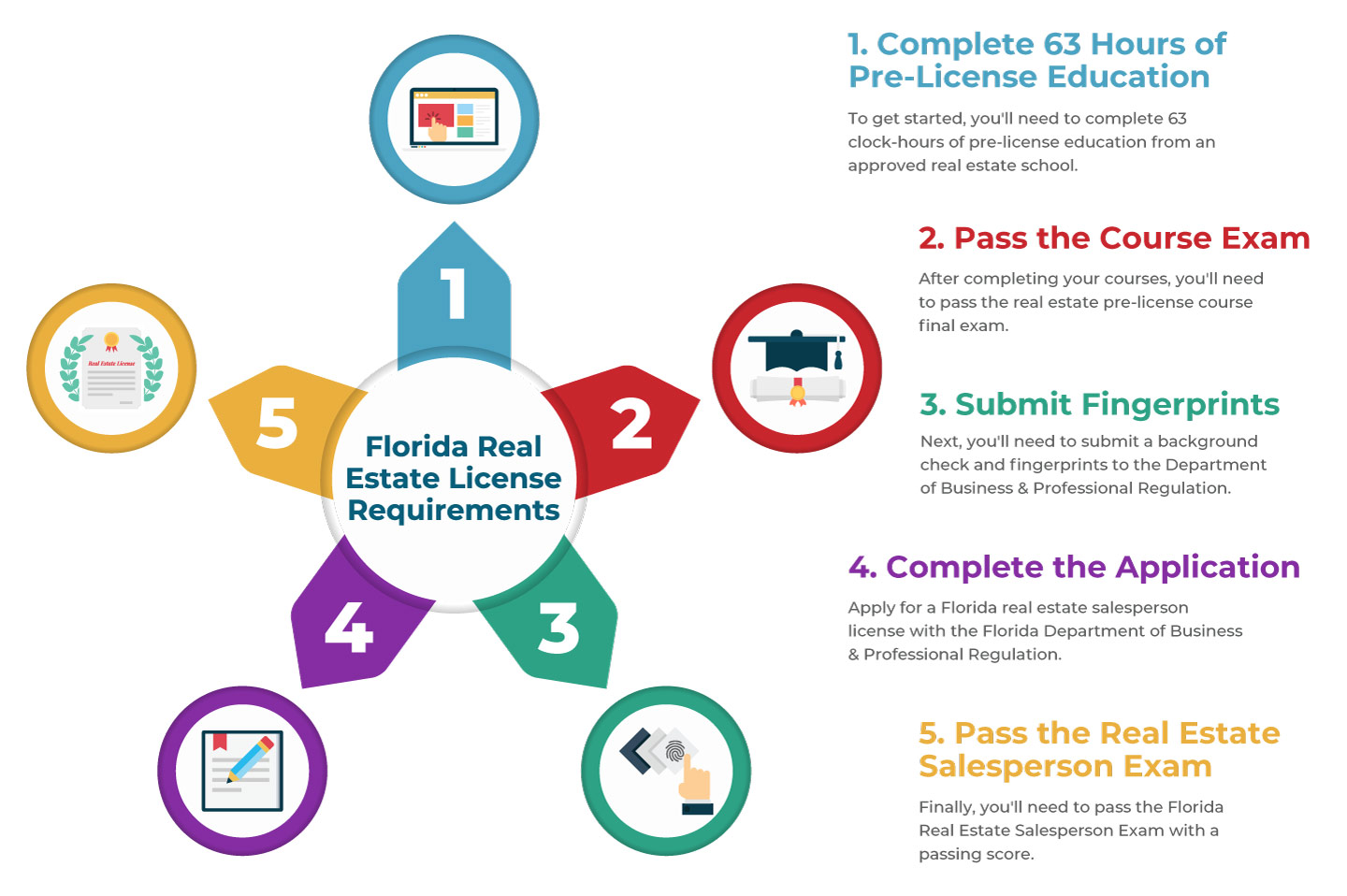

How to find real estate agents

A vital part of the real estate industry is played by real estate agents. They can sell properties and homes as well as provide property management and legal advice. The best real estate agent will have experience in the field, knowledge of your area, and good communication skills. For recommendations, check out online reviews and talk to friends and family about finding a qualified professional. Consider hiring a local agent who is experienced in your area.

Realtors work with both buyers and sellers of residential real estate. A realtor's job is to help clients buy or sell their homes. Apart from helping clients find the perfect house to call their own, realtors help manage inspections, negotiate contracts and coordinate closing costs. Most realtors charge commission fees based on property sale price. Some realtors do not charge fees if the transaction is closed.

The National Association of Realtors(r) (NAR), offers many different types of real estate agents. NAR membership is open to licensed realtors who pass a written test and pay fees. The course must be passed and the exam must be passed by certified realtors. NAR designates accredited realtors as professionals who meet specific standards.